Decentralized Finance (DeFi) is an umbrella term for various financial applications in cryptocurrency or blockchain geared toward building a new, internet-native financial system using blockchains to replace traditional finance. Today, it is one of the fastest-growing segments of the cryptocurrency industry.

In DeFi, there are no physical banks. Instead, there are pieces of code that run and act like a bank that is open to anyone. In other words, DeFi allows people to make financial transactions without banks and other intermediaries.

Nevertheless, DeFi projects have a lot of flows with scalability, security, centralization, liquidity, and accessibility to information. To address the issues of DeFi 1.0, DeFi 2.0 emerged. If successful, this new version of DeFi can help reduce the risk and complications that discourage crypto users from using it.

Let's take a closer look at how DeFi 2.0 works and why there is a need for it.

Limitations of DeFi 1.0

DeFi offers numerous benefits as it eliminates the fees banks and other financial companies charge for using their services and promotes peer-to-peer, or P2P, transactions.

Decentralized Finance is built on three main things: Cryptography (a method of protecting information and communications through the use of codes), Blockchain (an immutable ledger that facilitates the process of recording transactions), and Smart Contacts (programs stored on a blockchain that run when predetermined conditions are met).

One of the main DeFi goals is to reduce transaction times and increase easier access to financial services with lower fees. With DeFi, you can do most of the things that banks support, such as earn interest, borrow, lend, buy insurance, trade assets, and more. Compared to centralized institutions, you save time and don’t bother with paperwork or third parties. The process is almost the same as in blockchain, the information is open, and smart contacts implement a certain transaction if some terms are properly met.

The idea of having an accessible and fast financial network sounds great, but is it completely risk-free, and what are the limitations?

DeFi, like other things in life, includes risks such as coding errors or security vulnerabilities that may allow hackers to break the code and steal money from the protocol. Throughout the years, DeFi has gone through many improvements to overcome its limitations that emerge during the years:

1. Liquidity Mining

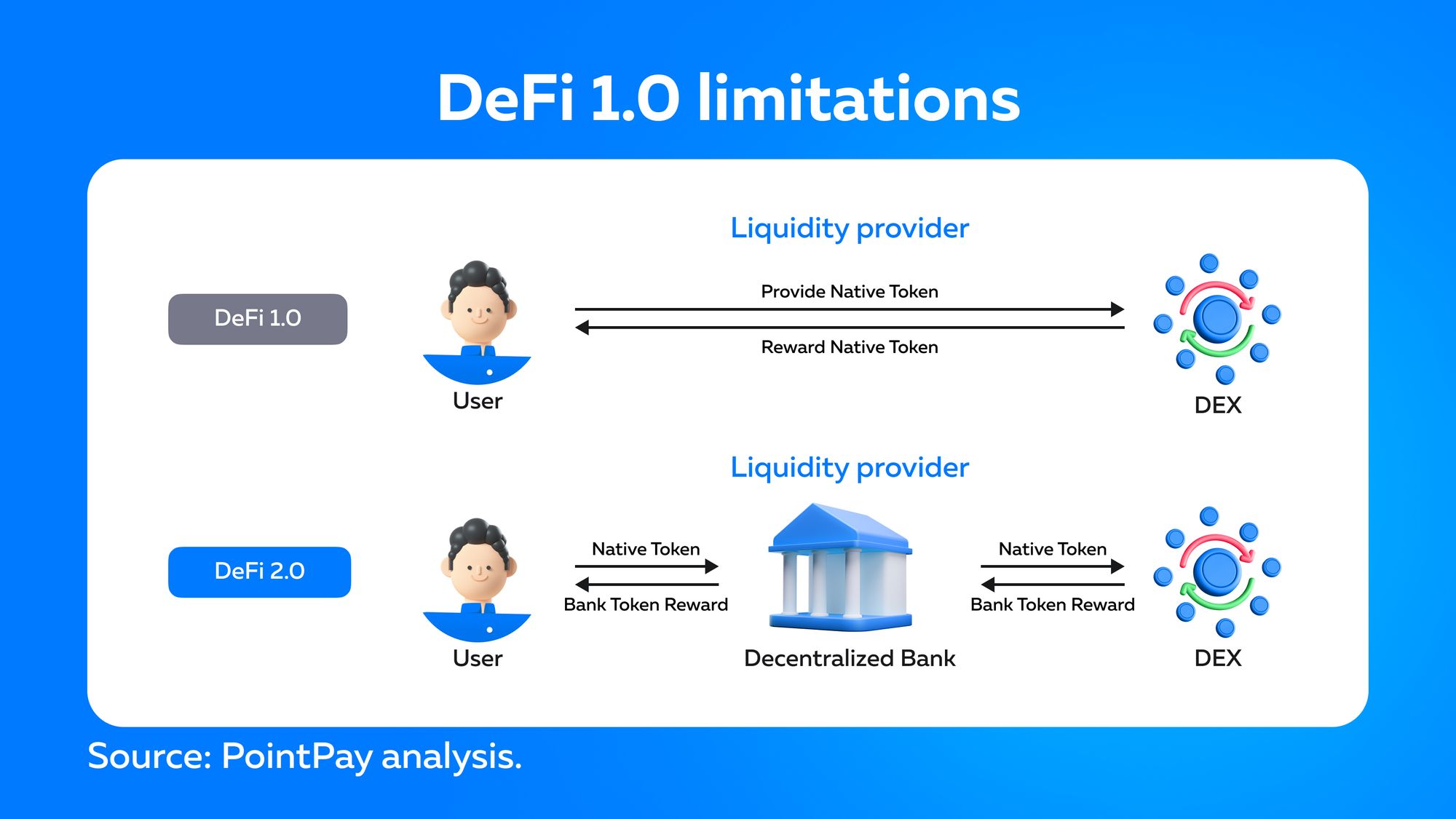

In DeFi 1.0, the community provides liquidity by depositing assets into the system. For example, users lock digital currency into a protocol to maintain liquidity on Decentralized Exchange. But they can lose out if the price ratio between the two tokens fluctuates. This phenomenon is called impermanent loss and is one of the main limitations of DeFi 1.0. In an upgraded generation, liquidity is provided by the protocol.

2. Security

The security issue that arises as a result of frequent software updates and revisions is another significant limitation that needs to be solved.

3. Scalability

When DeFi protocols gained widespread adoption, the network became increasingly congested during peak usage hours. Considering all the limitations of DeFi 1.0, the necessity to have an upgraded network was seen as a must. Therefore DeFi 2.0 came along, bringing solutions to the previous limitations.

What is DeFi 2.0?

DeFi 2.0 is the second generation of decentralized finance protocols. The configurations of DeFi 2.0 matter as they bring improvements to aspects such as liquidity, scalability, governance, user experience, and security. DeFi 2.0 is expected to preserve the legacy established by prominent DeFi protocols such as Uniswap, Aave, MakerDAO, Compound, and many others, meanwhile contributing to the expansion of the DeFi sector.

Key Features of DeFi 2.0

1. DeFi 2.0 offers scalability at a lower cost and a better user experience

With upgrades and changes in the foundation, DeFi 2.0 will be able to offer a more scalable network with an improved and easily manageable platform interface.

2. DeFi 2.0 helps unlock greater value from staked funds

Users had the option of staking a token pair in a liquidity pool with DeFi 1.0. They would then receive liquidity provider (LP) tokens, which could be staked once more using a yield farm to obtain extra benefits. Users can get more value from staked assets with DeFi 2.0 by adding more layers of functionality for yield farming. It enables users to utilize yield farm LP tokens as collateral for loans.

3. Next generation of DeFi offers better protection from financial losses

DeFi 2.0 offers insurance against impermanent losses for a small fee. This encourages investments in liquidity pools and protects investors from financial losses.

4. DeFi 2.0 Brings complete decentralization

Even if the idea behind decentralized finances is decentralization, many DeFi protocols have included some element of centralization. User funds are stored in smart contracts, which a certain group of individuals controls. This centralized aspect has led to a loss of faith among DeFi customers. The second generation of DeFi protocols allows users to participate in the protocol's governance and future growth.

Let’s look through some of the revolutionized DeFi 2.0 game changers expected to encourage the expansion of the DeFi economy.

Olympus DAO

Olympus DAO is one of the pioneers in the DeFi 2.0 movement. It is popular for its innovative protocol-owned liquidity (POL) model. The platform is a self-governing decentralized autonomous organization (DAO) that uses OHM as its native token. Olympus allows token holders to vote on important decisions much like any other DAO. Users can also stake OHM tokens to make money on the platform.

Convex Finance

The platform is built on stable exchange Curve Finance (CRV). Convex offers its users an opportunity to earn boosted rewards without having to lock in their tokens. The platform has no withdrawal fees and charges little for other performances. The DeFi project aims to help users boost their rewards and enjoy better UX by offering a user-friendly and easy-to-navigate platform for CRV pledging and liquidity mining.

Rari Capital

The protocol aims to make DeFi finance accessible to people without a tech background. It greatly simplifies investment activities such as lending, borrowing, and yield farming.

DeFi has always been viewed as a game changer in financial systems. But we have yet to discover how it can improve financial systems. With the new innovative DeFi 2.0, there will be more engagement in blockchain technology which will boost the industry further.

Nevertheless, there's still work to be done to simplify the usage of decentralized platforms, especially for new users. We've seen success in ways to reduce risk and earn interest, but we'll have to wait and see what opportunities for financial freedom the DeFi 2.0 movement will bring.

🔥 Buy PXP tokens on Bittrex: https://bit.ly/32VWsci

🔥 Buy PXP tokens on Bitrue: https://bit.ly/3JEreHu

🔥 Buy PXP tokens on BitHumb: https://bit.ly/3qOK6e9

🔥 Buy PXP tokens on WhiteBIT: https://bit.ly/3qJrjRH

🔥 Buy PXP tokens on CoinTiger: https://bit.ly/3pnv6ny

💰 Earn up to 7% yearly with PXP staking program in PointPay Bank: https://bank.pointpay.io/staking

💡 Check PointPay Live-Roadmap (PointPay development in real-time): https://pointpay.io/live-roadmap/

🏦 Remember, we are PointPay, and we are beyond banking!