Cryptocurrencies like Bitcoin and Ethereum offer many advantages, including decentralization, peer-to-peer transactions, etc. However, one of the biggest drawbacks of cryptocurrencies is volatility. This means that their prices are unpredictable and prone to significant fluctuations.

Stability is a valuable asset in a volatile cryptocurrency market. This type of cryptocurrency combines the stability of traditional assets with the flexibility of digital assets. Although their work varies from coin to coin, stablecoins are more resistant to volatility, so you should not experience large price fluctuations.

Stablecoins are less prone to fluctuations as their value is pegged to the value of more stable assets such as fiat currencies. Let's look at what stablecoins are, their advantages and disadvantages, as well as the most popular on the market.

Stablecoin definition

Cryptocurrencies tied to a particular fiat currency (that is, fiat currency - the dollar or euro) or a physical asset (for example, gold) are called stablecoins. In theory, a stablecoin can be bought or sold at a fixed price at any time. When this type of digital currency is exchanged for fiat money, a stablecoin, as a rule, is "burned" and goes out of circulation. At the same time, the stablecoin has all the qualities of a cryptocurrency, but, unlike bitcoin or ether, it is not subject to sharp price fluctuations.

Volatility is a major problem for those who view cryptocurrencies as a currency rather than an investment. Over the past year, bitcoin has fallen below $50,000 and has risen above $60,000 more than five times. Due to constant drops, Bitcoin and altcoins are often classified as risky assets. These words are confirmed by the recent drop in the Bitcoin price - over the past month; it has fallen in price by 30%, dropping below $30,000 per coin.

Stablecoins use cases

As a digital asset that maintains a value, stablecoins can be used in several ways:

- Hedge against volatility: Investors can hedge against volatility by strategically buying stablecoins that allow exposure to other cryptocurrencies. Owning stablecoins during periods of significant market volatility can help to stabilize a portfolio's value.

- Display of price in fiat money: A digital asset listed on a cryptocurrency exchange can be priced in fiat money using a stablecoin.

- Stable price-pegging: A stablecoin's price stability can make it suitable for representing ownership or fund investments, as well as liabilities or debt.

- Money transfers: Stablecoins can be used to send funds overseas without needing a bank account or worrying about currency fluctuations.

- Hedge against inflation: Investors worried about inflation of their local currency can hold stablecoins to help protect the value of their money.

- Crowdfunding: Startups and nonprofits can raise money from investors and donors worldwide by soliciting cryptocurrencies. Raising funds in stablecoins, such as Tether, ensures that the value of the money raised does not fluctuate over time.

The Emergence of Stablecoins

There has always been a need to digitalize fiat since the advent of the Internet. Entrepreneurs or institutions have tried to create a digital dollar and launched BitUSD.

First stablecoin: BitUSD

Launched at the dawn of cryptocurrencies in 2014, BitUSD was the first stablecoin to be issued as a token on the BitShare blockchain. The idea for the pioneering stablecoin came from Charles Hoskinson and Dan Larimer. The main BitShares token, BTS, and several other cryptocurrencies back the token - all locked in a smart contract acting as collateral.

The rise of Tether

Tether cryptocurrency (USDT) was launched in 2014 by Tether Limited. The team presented a simple concept of creating a cryptocurrency that maintains a stable price. For each USDT stablecoin issued, Tether held $1 in reserve. The goal of Tether was to keep the USDT price pegged to $1, with each USDT token being redeemable for one U.S. Dollar from the reserve. USDT started very slowly but skyrocketed during the 2017 Bitcoin bull market when its total supply reached nearly 10 million.

Protocol

USDT was originally designed to use the Bitcoin blockchain (Omni and Liquid Protocol) as a transport protocol that allowed transactions with tokenized fiat currencies. Because the original Tether protocol uses the Bitcoin network, it inherits the security and stability of the Bitcoin blockchain. Currently, Tether tokens use multiple protocols, including Ethereum, Algorand, Bitcoin Cash, EOS, Tron, and OMG.

The Tether goal

Tether's goal was to allow people to quickly and efficiently transfer value from one exchange to another without using volatile crypto assets. The pegged to the U.S. dollar cryptocurrency appeals to both institutional and retail investors. Its relevance as an alternative to fiat gives market participants the option to put their investments on hold when the market is volatile.

Controversy

The major stablecoin on the crypto market also raises the most controversial issues. Critics of Tether argue that the stablecoin is not backed by actual U.S. dollars but instead creates new USDT tokens out of thin air.

The criticism arose after Tether hit a hurdle in 2018. Instead of being audited, the company parted ways with an audit firm. A year later, the New York Attorney General tested the currency and acknowledged that the U.S. dollar does not fully support the token. This has raised enough suspicions about USDT and whether it has enough reserves to back the token or not.

However, Tether claims to issue new coins in response to need – for example, if you give Tether $1, you will receive $1 in return. Tether claims it doesn't publicly release its audits because it wants to keep regulators from knowing how dollars are converted into Tether.

USDC is the next

Circle launched USDC, a token that is pegged to the U.S. dollar at a 1:1 ratio, in September 2018. The token was created in partnership with Coinbase - one of the biggest cryptocurrency exchanges. The company behind Circle also owns Poloniex, with investors in well-known companies like Baidu and Goldman Sachs.

CENTRE launched the USD Coin (USDC) to provide a stablecoin with strong governance and transparency, unlike Tether. The project behind USDC tries to solve the problem of stablecoins by publishing monthly public attestations of its fiat holdings and providing clear rules and guidelines regarding asset issuance and redemption.

The conversion of USD to USDC is a three-step process:

- A user sends U.S. dollars to the bank account of the token issuer;

- The issuer creates an equal number of USDC tokens using a smart contract;

- The user receives a newly issued USDC. The replaced amount in U.S. dollars is retained in reserve.

Protocol

USDC was launched on the Ethereum network in 2018 but is currently issued on multiple blockchains. Rising gas fees on the Ethereum network have prompted the need to launch the token on other networks with relatively lower fees. Therefore, the coin was released on several networks, including Algorand, Solana, and Stellar.

True USD

The TrustToken asset tokenization platform launched TrueUSD in 2018. TrueUSD is a stable cryptocurrency that is fully collateralized and legally secured. Instead of storing U.S. dollars in one place, the TrueUSD system holds collateral in the bank accounts of various fiduciary partners who have signed escrow agreements. These bank accounts are subject to monthly review to ensure TrueUSD is credible.

DAI

DAI, launched in 2017, is an Ethereum-based stablecoin pegged to one U.S. dollar. The ERC-20 stable token is also used in the MakerDAO credit system. Whenever someone takes out a loan through MakerDAO, DAI is created. The price of each stablecoin is controlled by auto-executing smart contracts. If the price rises or falls, DAI stablecoins are created or burned to stabilize the price at one dollar.

Protocol

The protocol behind the DAI stablecoin is an open-source platform that anyone can use to create DAI tokens against cryptocurrency collateral assets. DAI was created by Maker Vault users, who can deposit crypto using the Oasis.app to create DAI. Initially, DAI was launched with only support for pooled ether (PETH), which can be obtained by depositing ETH in a smart contract.

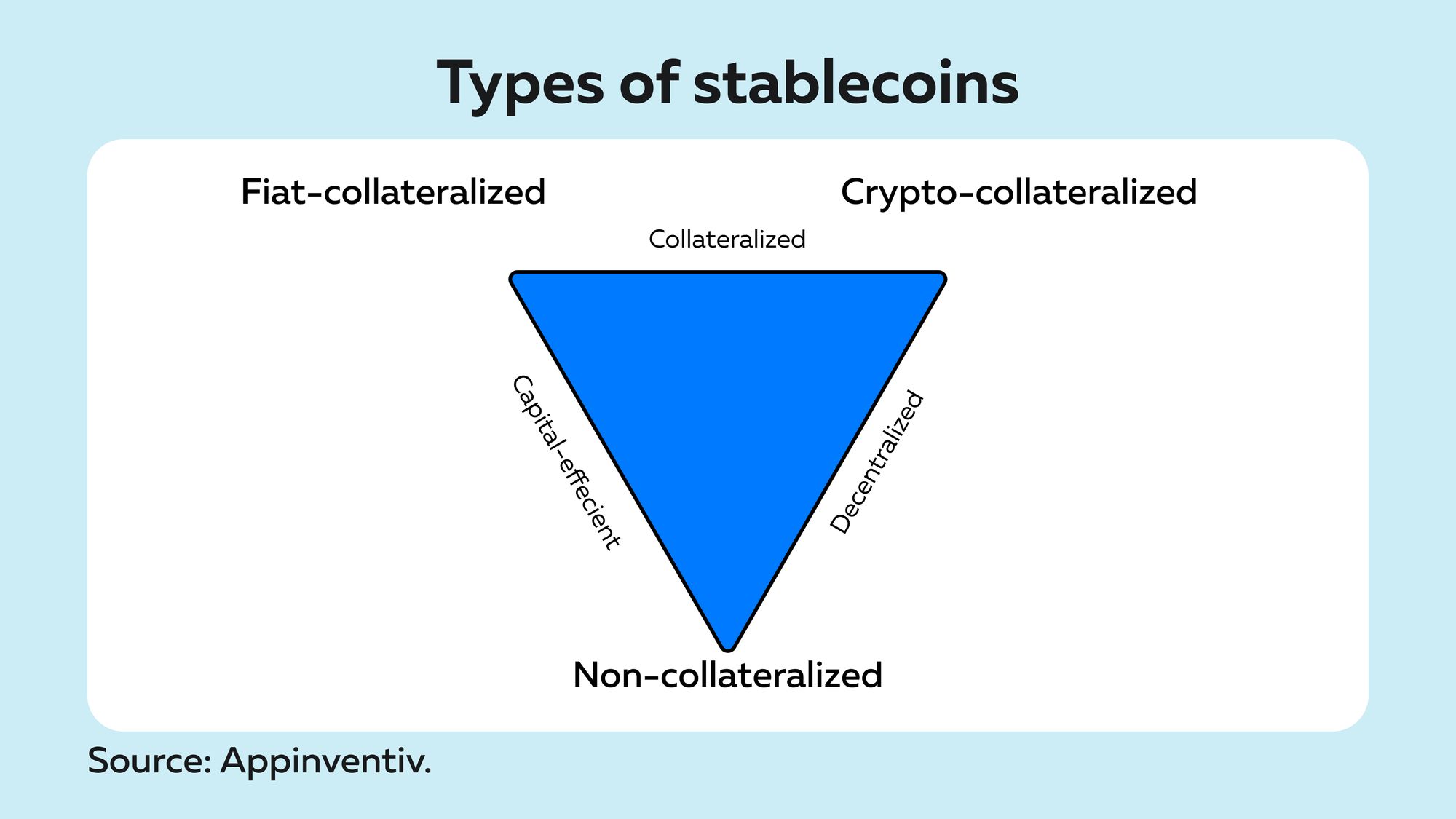

Types of Stablecoins

In the cryptocurrency market, there are four main types of stablecoin:

- Fiat-collateralized stablecoins

These are the most common types of stablecoins backed by a 1:1 ratio, which means that one stablecoin can be exchanged for one currency unit. Fiat-backed stablecoins are backed by fiat currencies such as euros, U.S. dollars, or pounds sterling. For every stablecoin, a fiat currency is held in the treasury to back it up. The goal is to back the stablecoin with real money in real bank accounts. Although the category of this stablecoin is the simplest, it is also the most centralized. The central authority acts as the custodian of the fiat reserve and manages the entire process of issuing fiat-backed tokens and receiving new fiat.

Examples of fiat-collateralized stablecoins are Tether (USDT), Gemini Dollar (GUSD), and TrueUSD (TUSD).

Pros

- The structure of fiat-backed stablecoins is simple;

- Fiat is considered stable, which ensures low volatility;

Cons

- Centralized structure makes room for hacking and bankruptcy;

- Issuer requires credibility;

- There is a need for regulations and checks.

- Crypto-Backed Stablecoins

Cryptocurrencies are also used to back stablecoins. A crypto-backed stablecoin works the same as a fiat-backed stablecoin; however, instead of using fiat as collateral, cryptocurrencies are locked in as collateral that backs a stablecoin. The digital used to back the stablecoin uses a "security margin" to offset price fluctuations.

This is a more complex and varied solution than other types of stablecoins that are backed by fiat currency reserves. Smart contracts enable decentralized regulation, which can help avoid problems caused by bugs in the code. The main pitfall of this type of stablecoin is its change in value and reliance on supplementary instruments. Complexity and non-direct backing may deter usage, as ensuring the price may be difficult to comprehend. Due to a highly volatile and convergent cryptocurrency market, a very large amount of collateral must be maintained to ensure stability.

Examples of crypto-backed stablecoins are Wrapped Bitcoin (WBTC) and DAI.

Pros

- Decentralized regulation;

- No need for a keeper;

- No regulations or audits are required;

Cons

- The structure of a stablecoin backed by a cryptocurrency is more complex;

- Too much reliance on secured cryptocurrencies.

- Non-Collateralized Stablecoin

Seigniorage-style coins, also known as algorithmic stablecoins, control the money supply of a stablecoin through algorithms, just as central banks do with printed currency. Algorithmic stablecoins are less popular than other types. The projects can adjust their coin supply based on factors such as demand and are created without collateral.

Examples of non-collateralized stablecoins are TerraUSD (UST) and Basecoin (BAB).

Pros

- No need for collateral;

- The highest level of decentralization;

- Smart contracts create a reliable system;

Cons

- Most vulnerable to a potential crypto crash;

- The scheme of implementation is very complex;

- Require constant system growth to work as intended.

- Commodity-backed stablecoins

Commodity-backed stablecoins can be created with fungible assets such as precious metals. Gold is the most commonly-used commodity to back fiat stablecoins, but some are backed by real estate, oil, or other precious metals. Collateral is often stored in a third-party vault.

Examples of commodity-backed stablecoins are Tether Gold (XAUT) and Paxos Gold (PAXG).

Pros

- Real assets back each commodity-backed stablecoin;

- The price of goods is relatively stable;

- Commodity tokenization brings more liquidity to the market;

Cons

- Centralized structure makes room for hacking and bankruptcy;

- Issuer requires credibility;

- There is a need for regulations and checks.

Future of stablecoins

The purpose of a stablecoin goes beyond a simple financial contract. The purpose of stablecoins is to evolve the traditional payment system, offering the same monetary benefits as fiat currencies—stable value and ease of international transfer. Stablecoins can open new doors for the widespread adoption of digital assets in everyday life.

Stablecoins have great potential to change the global payments landscape, but it may take some time to fully develop in the digital space.

Are stablecoins stable?

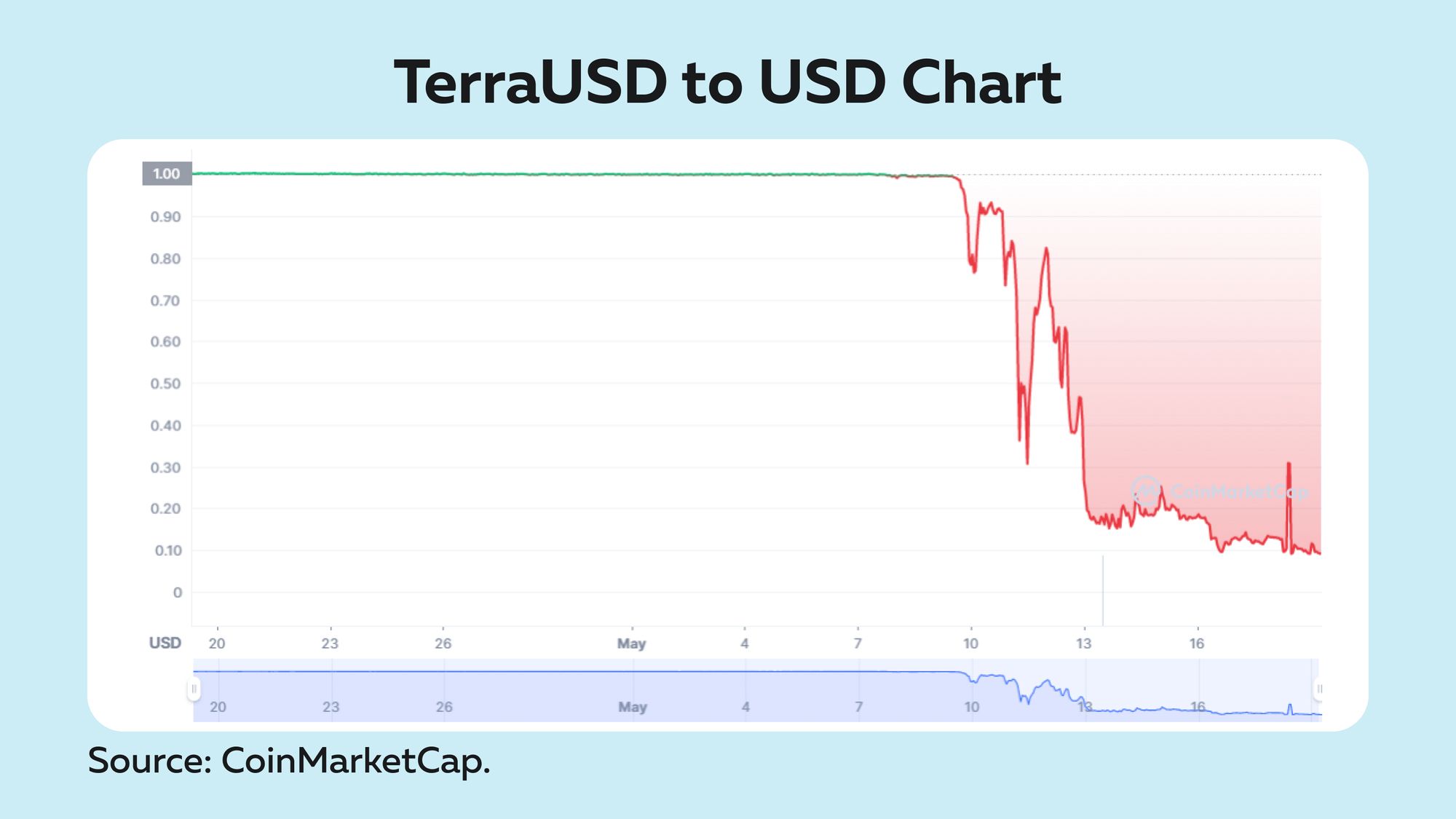

However, the stable world of stablecoins recently faced the biggest shock in its short history. On May 9, the stablecoin TerraUSD (UST) rate, which was supposed to stay at the level of $1, fell to 76 cents. By the end of the week, UST fell below 20 cents, and Binance, the largest crypto exchange, suspended trading in both the stablecoin and its associated Luna token.

UST was one of the largest cryptocurrencies by capitalization - $18.5 billion. It belongs to algorithmic tokens. If the UST rate fell below $1, some of the tokens were automatically "burnt," converting into the Luna cryptocurrency; if the rate was above $1, everything happened the other way around - part of the Luna tokens were withdrawn from circulation, and an additional issue of the UST took place. In addition, traders who make money from arbitrage trading (quote differences) regularly exchanged UST for Luna - in theory, this should have ensured that the price of UST would remain at or very close to $1.00.

In May, the agorithm stopped working: Luna, which was quoted above $80 on crypto exchanges as early as May 4, began to cost $30 by May 9 and reset to zero by May 12.

There was nothing to maintain the stability of the UST. U.S. Treasury Secretary Janet Yellen has already commented on the situation with TerraUSD. According to her, the collapse of the stablecoin shows how dangerous the coins, which are allegedly pegged to the U.S. dollar, and called for the speedy development of regulation of this industry.

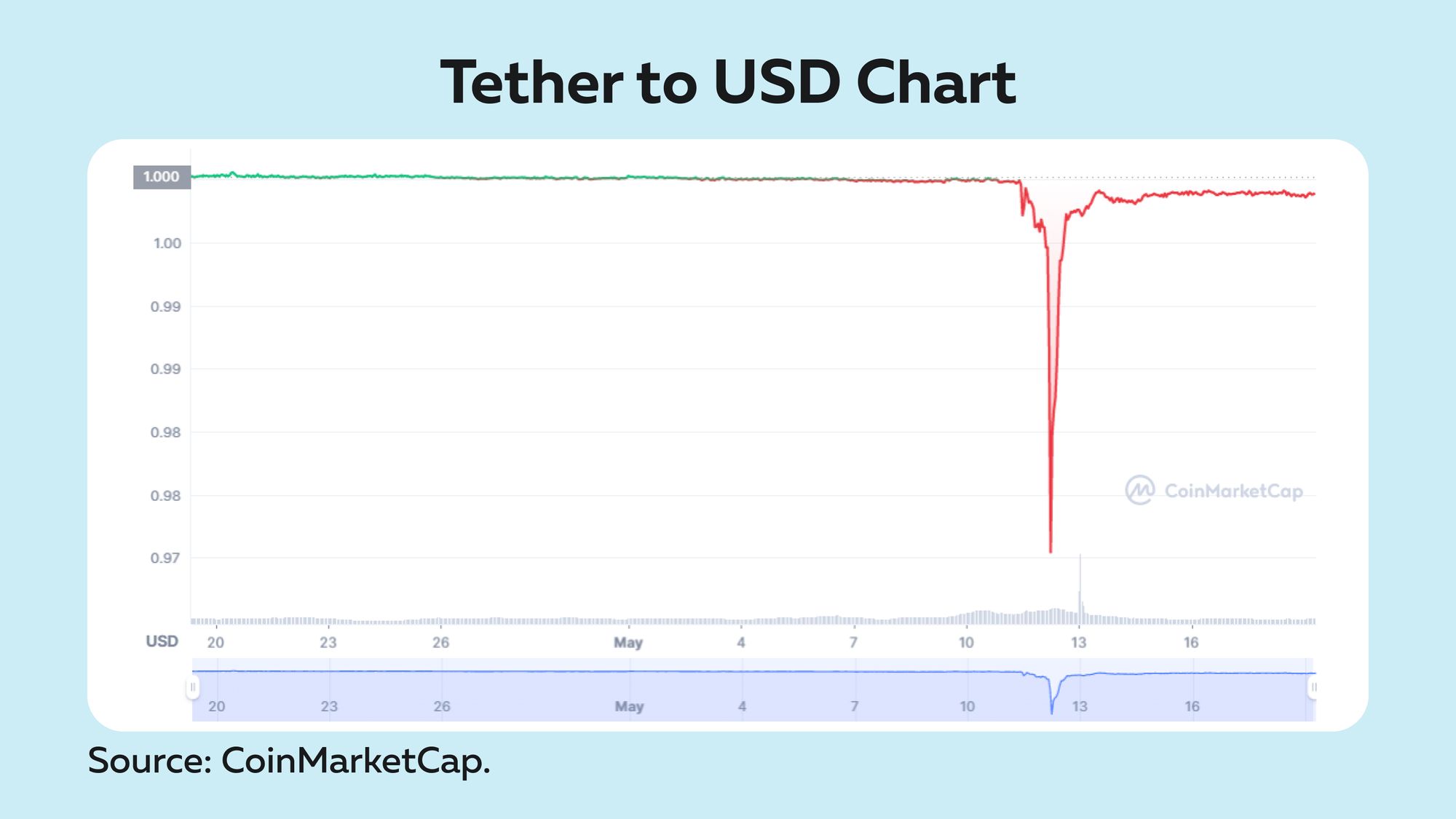

The price of the cryptocurrency Tether, the world's largest stablecoin, fell below its $1 peg Thursday, May 12, amid a growing selloff in the crypto market. The cryptocurrency, which is meant to be pegged 1-to-1 to the U.S. dollar, sank to 95 cents on several exchanges.

Tether's initial decline came after the price of terraUSD fell below 30 cents Wednesday, leading to fears of a contagion affecting the cryptocurrency market. Friday, Tether (USDT) was trading at $1 again, calming investors' fears about a contagion of the crypto market's volatility from the collapse of the embattled stablecoin project Terra.

These lessons remind us that any cryptocurrency, including stablecoins, cannot be a low-risk instrument. Stablecoins neutralize market risks, such as price fluctuations, but credit and liquidity risks are still high. You cannot freely withdraw stablecoins to a reliable bank account, and the issuer, as in Terra's case, cannot always fulfill its obligations. The fall of Terra as a whole can undermine the credibility of stablecoins as reliable instruments.