A fork is a change in the blockchain rules that recognizes a block as authentic. This is similar to splitting a fork into two separate parts, hence the name “fork.” Forks can result in a coin receiving more memory, faster mining, and better decentralization or scalability.

When a cryptocurrency is forked, one of the new chains can die out or continue to exist. The consequences depend on how much hash power each branch has. A branch with greater power has a high chance of survival, but this isn’t guaranteed.

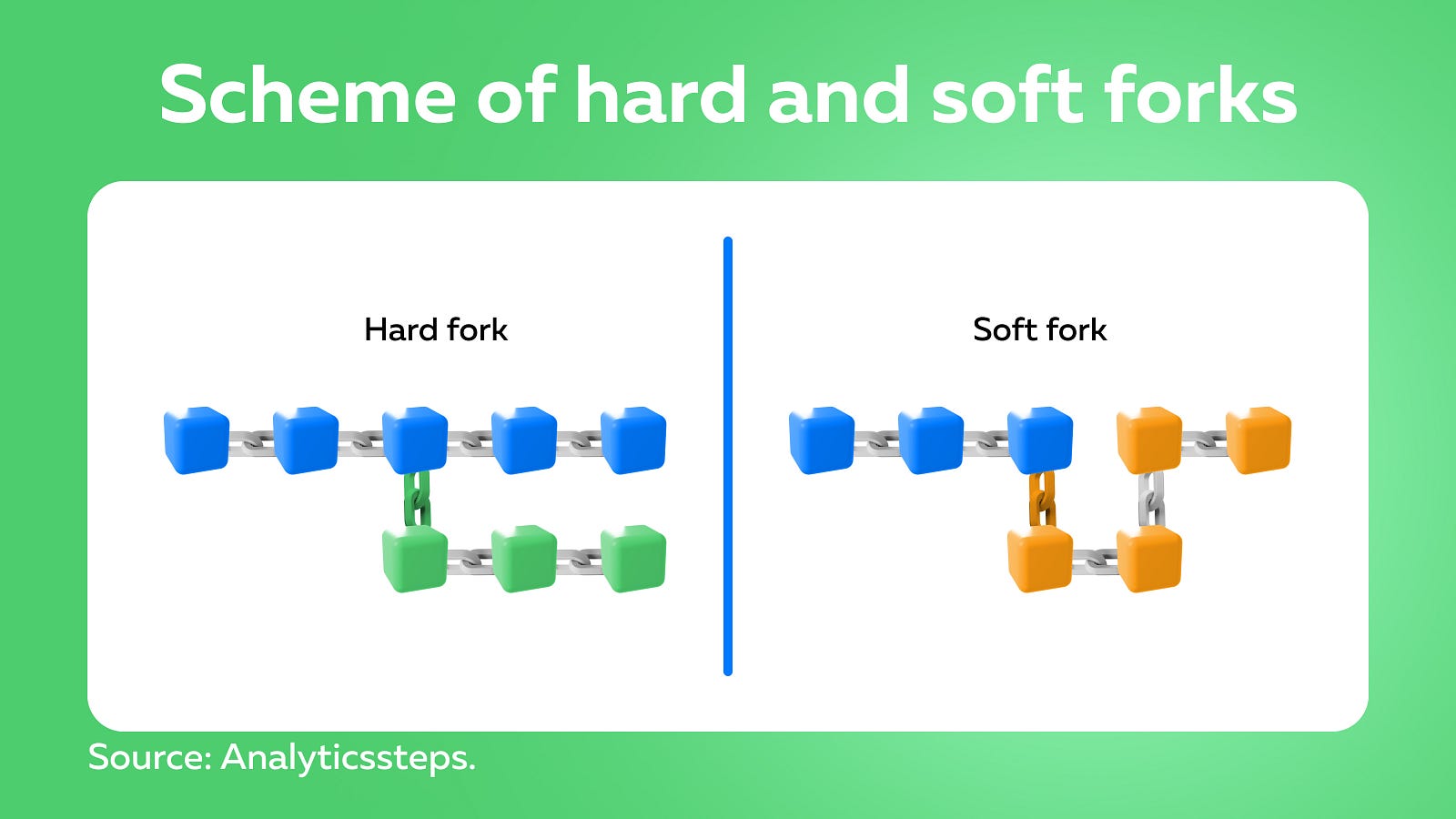

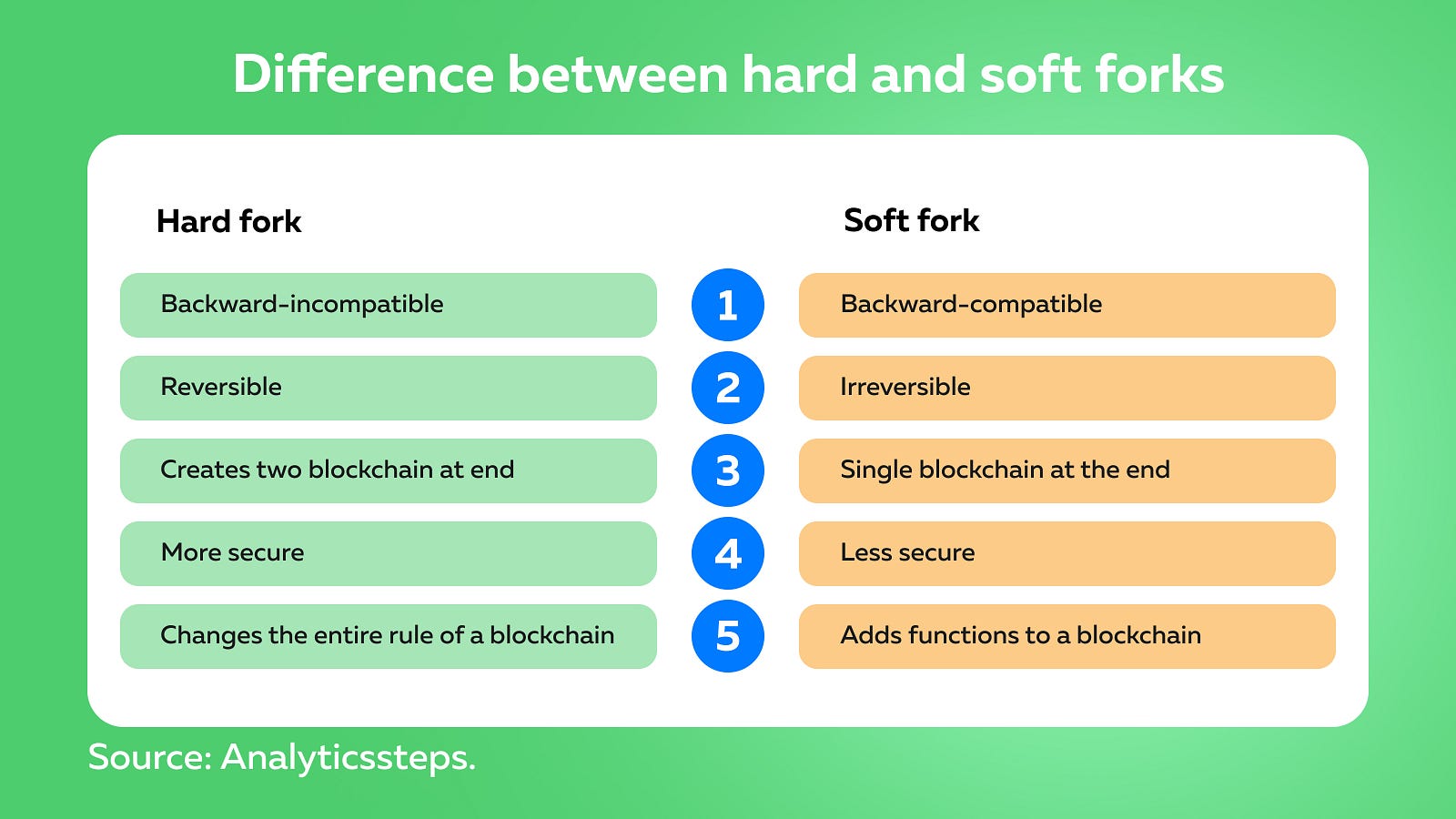

Forks come in two types: hard and soft.

What is a hard fork?

A hard fork occurs when changes are introduced to the blockchain that separates it into two distinct chains. Some examples of hard forks include Bitcoin Cash, Bitcoin Gold, and Ethereum Classic.

Because most cryptocurrencies are open source, anyone can launch a hard fork. Usually, the initiators are regular members of the community — developers, miners, and well-known traders. After that, a group of like-minded community members gathers to implement their plan.

Sometimes a cryptocurrency can split into two branches when disagreements among community members reach the boiling point. For example, this happened with Bitcoin Cash in November 2018, when it “forked” into two different versions of itself (BCHABC and BCHSV).

Reasons for hard forks

The most popular reason for hard forks is the desire of most users to change the source code. If the community’s vision is shared, they can hardfork and develop their own version of the network.

Also, hard forks allow the network to be rolled back if it’s been hacked. A famous hack example was the project DAO, where $60 million worth of Ethereum was lost to an anonymous attacker. At the time, Ethereum was trading for less than $10, so about 14% of all circulating Ether was invested in DAO. Initially, Ethereum founder Vitalik Buterin proposed a soft fork that would blacklist the attacker’s address and prevent him from transferring the money. The attacker threatened to thwart all soft fork attempts by bribing ETH miners with the stolen funds.

The debate continued until a hard fork was proposed. The hard fork was eventually implemented, and the history of the Ethereum network was reset to what it was before the attack at DAO. The funds were allocated to a smart contract to allow investors to withdraw their money.

This move was highly controversial — some observers, it undermined the censorship resistance and immutability of the blockchain. The opponents rejected the hard fork and continued to support an earlier version of the network, now known as Ethereum Classic (ETC).

How do hard forks happen?

To hardfork the network, the nodes must use the same software version. For example, the developers have proposed halving the fees. Not everyone will agree with this. In a traditional democratic system, the minority is outvoted by the majority and must abide by new rules. In the blockchain consensus, a minority can break out and continue to use their version of the future by initiating a hard fork. This gives flexibility to decentralized protocols.

A hard fork can also be carried out by “backdating.” If blockchain users have been seriously damaged, they can restore the network from the height they need, accurate to the block number. This is a great way to roll back the state of the network, for example, before the hack.

It’s important to note that cloning the blockchain isn’t a fork. Litecoin, Peercoin, DASH, and Dogecoin use modified source codes from Bitcoin, but they aren’t hard forks. This is because their networks are launched from the 0 genesis block and aren’t branches of the main Bitcoin network. BTC’s private key isn’t compatible with such cryptocurrencies.

What is a soft fork?

To understand what a fork is, let’s describe how a cryptocurrency hard fork differs from a soft fork. In the first case, a completely new coin is created based on the code of the “donor coin,” In the second case, it’s launched from the block where the fork took place.

A soft fork is a form of currency separation where the nodes of the old version can interact with the nodes of the new version. A soft fork is an upgrade rather than a revolutionary change. No new currency will emerge after the fork.

One of the most well-known soft forks is Bitcoin’s Segwit fork. This milestone changed the structure of the blocks in the Bitcoin chain. Thus developers were able to increase the number of transactions per block. As a result, miners were better rewarded for their work.

Another goal was to reduce the size of the commissions. This increased the blockchain’s throughput and scalability and reduced the transaction confirmation time. It also decreased the queue in the mempool, enhanced the system security, and made transactions less flexible. Multiple signatures emerged, minimizing the likelihood of asset theft.

This fork also optimized the blockchain, making it easier for developers to implement smart contracts, the Lightning Network, and other important functions. After the success of the first soft fork, Bitcoin had two more.

What are the benefits of forks?

Increased security, privacy, and backward incompatibility are some of the reasons why most major platforms opt for hard forks. Hard forks are more secure because all nodes need to be updated if most miners update and adopt the new rules.

For instance, the hard fork allowed DAO holders to get their ETH back and didn’t roll up the network’s transaction history but transferred the funds to a newly formed smart contract. Since two versions of a blockchain can exist simultaneously in hard forks, the owners of DAO got their money back, and the hacker’s transactions could be reversed.

Soft forks are valuable because they’re less computationally intensive and allow easier upgrades to implement new features. Nodes don’t have to migrate to the new protocol. Since all the new protocols in the soft fork follow the old rules, they’ll be accepted by the old users. Both types of forks split the blockchain, but hard forks create two separate blockchains while soft forks are meant to result in one.

Let’s wrap this up!

Hard and soft forks are used to update cryptocurrency networks in a similar way that software updates are used to improve other technologies. Hard and soft forks can be used in updates for new features and implementations. Soft forks don’t require the entire upgrade, and lower computer costs are required.

Hard forks are most commonly used because they provide additional security, and it’s often the goal of any blockchain network upgrade to improve security features. If transactions need to be reversed due to a security breach, hard forks are needed to redistribute the funds back to their original location.