Cryptocurrency burning has been touted by some as a way to help increase the price of a coin or token. Does it actually work? In November 2021, the Terra blockchain project undertook a massive token burn exercise, burning $4.5 billion USD worth of its LUNA cryptocurrency.

LUNA’s price spiked immediately after the burn event, but just six months later, the project suffered a catastrophic decline in fortunes, leaving the coin essentially worthless. Many crypto investors, including those attracted by the platform’s widely publicized token burn, lost their livelihoods, or at least a good portion of their wealth, in the Terra debacle.

In this article, we detail all the nuts and bolts of crypto burning to help you become well-informed on this controversial topic that, at times, goes hand-in-hand with PR stunts and unsubstantiated claims.

What Does It Mean to Burn Cryptocurrency?

So, what is a coin burn, actually? Crypto coin burn is the process of taking crypto coins or tokens out of circulation and the crypto’s total supply by sending them to an unusable and permanently inaccessible address on the blockchain. Blockchain addresses used for burning crypto are often referred to as burner addresses.

The burner addresses can accept crypto funds, but there is no way for these burned coins to be further spent or used by anyone on the network. The addresses do not belong to any person, and there is an infinitely low probability of anyone guessing the private key to such an address.

Any crypto user may send their funds to a burner address and essentially destroy them, though there is no reason for an individual crypto holder to do so other than a fit of mad rage.

Token burning is normally undertaken by crypto projects with the goal of decreasing their token’s supply. The decreased supply should, at least in theory, lead to an appreciation in the value of the crypto.

Projects typically widely publicize their token burn events, trying to attract the attention of the crypto community in the hope of driving interest in the project. The rationale is that the burn event would convince prospective investors of the crypto’s good potential for future value increases.

Reasons Why Projects Burn Cryptocurrency

Projects might burn cryptocurrency for a variety of reasons. Some of these are quite genuine, while others might be somewhat sinister. The reasons for a token burn exercise by a crypto project often include:

- Expectation of price increases due to the reduced supply. This is by far the most common goal sought in crypto burning.

- Attempts to reduce the coin’s inflation rate. While the inflation rate for fiat currencies refers to their price increases, in the world of crypto, inflation is defined as the increase in cryptocurrency’s supply. Some cryptocurrencies have a mechanism of supply increase that results in an excessive inflation rate. Burning might help reduce the rate of the crypto’s inflation.

- As a publicity stunt to attract attention to a new or existing project. In some cases, project owners may be less concerned with the potential for price increases, and burn crypto with the primary goal of attracting attention to the project.

- To mask or distort large shares of the cryptocurrency held by the platform owners when initially promoting the project. Let’s say a new crypto platform initially issues one million tokens. The project’s developer retains 100,000 tokens (10% of the total supply) at the outset and widely publicizes this relatively modest ownership share in the project’s whitepaper and other promo materials.

After attracting the initial user base, who purchase another 200,000 of the token, the developer proceeds to burn 700,000 (70%) of the total supply. After the token burn, the total supply now stands at 300,000, of which the developer’s share is 100,000 (33%), a share that they might have planned to own from the beginning.

While the initial 10% share might not have alerted potential investors, the much larger 33% could act as a significant investor deterrent since many crypto investors are, rightfully, wary of very large token shares held by one party.

Prominent Cryptocurrency Burn Events of the Past

Some cryptocurrencies have regular burns built into their functional mechanism, while others might conduct ad-hoc, one-time burns. It is the latter cases that have attracted the widest publicity, often due to the project’s intentional heavy marketing of their burn event.

At the beginning of our article, we mentioned the massive-scale burn undertaken by Terra for its LUNA token in November last year. Although LUNA coins were regularly burned as part of the platform’s usual working mechanism, the November burn was an out-of-pattern, large-scale, ad-hoc burn event.

A total of 88,675,000 LUNA (valued at around $4.4 billion USD at the time) were burned on that occasion. Within a couple of weeks of the burn, LUNA’s price started to climb, and by late December, the token had doubled in price (from around $50 USD before the burn to nearly $100 USD by December 25).

The initial spike seemed to suggest that the burn event did benefit the token. However, over the subsequent few months, LUNA performed inconsistently, with ups and downs along the way. Thus, the large-scale burn failed to benefit the token in the long run.

In early May 2022, six months after the burn event, the Terra project suffered a catastrophic breakdown in performance that was not related to a hacker attack or other malicious activity. Simply speaking, Terra’s business model failed, which made both of its tokens, LUNA and UST, virtually worthless and prompted the project’s developer, Terra Labs, to halt the blockchain.

While Terra’s failure cannot be specifically blamed on the November burn, the large-scale burn event has certainly not proved beneficial for the project.

Another high-profile burn event is associated with the Shiba Inu (SHIB) token, the primary competitor to Elon Musk’s obsession — Dogecoin (DOGE). In May last year, Shiba Inu developers sent over 500 trillion SHIB tokens (worth around $7.5 billion USD at the time) to Ethereum’s founder Vitalik Buterin.

Buterin donated 10% of the amount to charities and burned the remaining 90% (worth around $6.7 billion USD), in what is probably the largest token burn in crypto history undertaken by an individual rather than a blockchain project as part of its operations.

The token burn halved SHIB’s total supply, but there was no significant positive effect on the token’s price, at least for the next few months after the event. SHIB did experience a short period of rapid growth in October 2021, but the reasons for the price rally were largely unrelated to Buterin’s disposal of the tokens five months prior.

Cryptocurrency Burns by Leading Coins

While the Bitcoin (BTC) blockchain does not use regular burns, two other leading cryptos — Ethereum (ETH) and Binance Coin (BNB) — have burn mechanisms built into their functionality.

Ethereum Burns

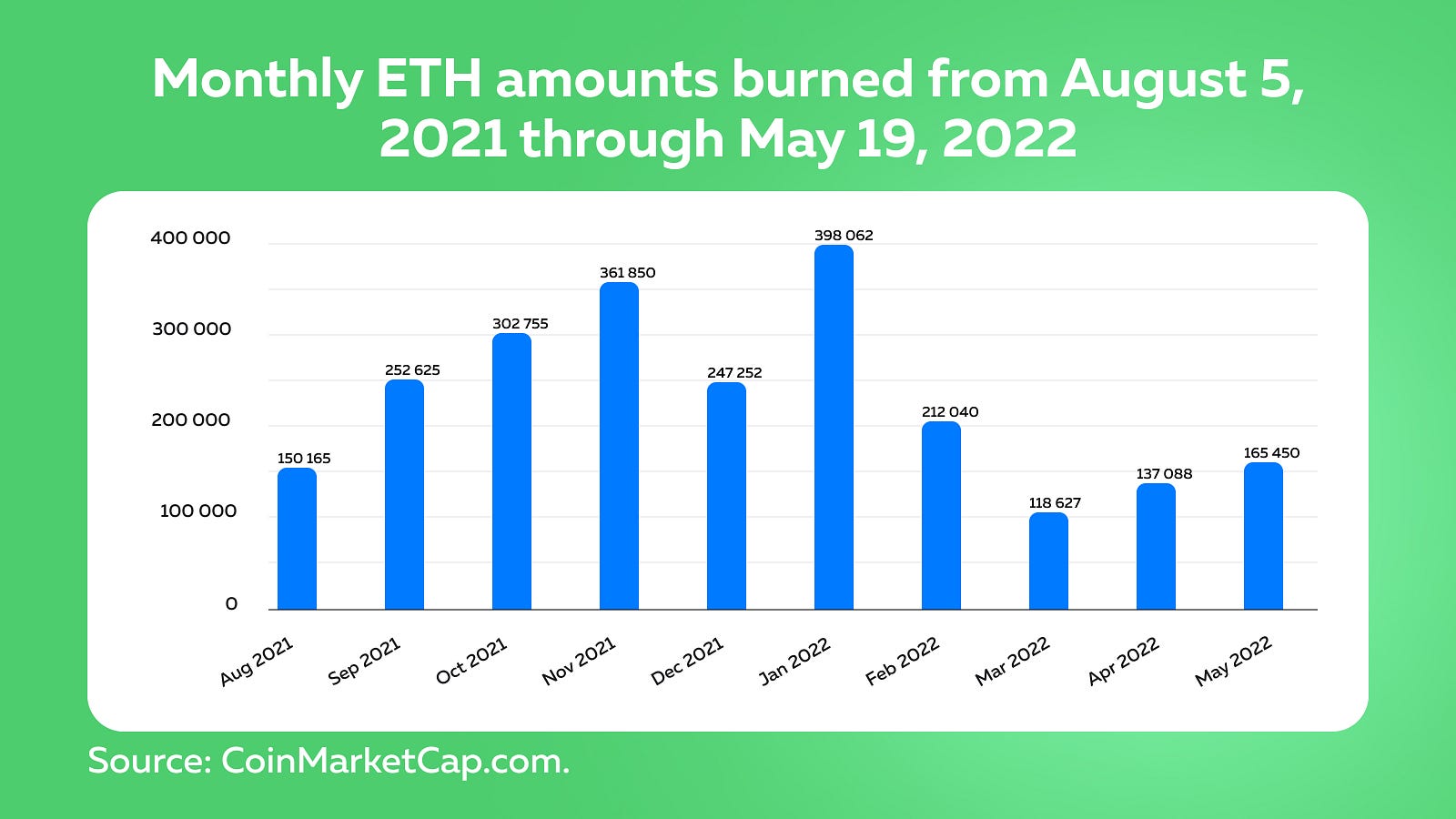

Since the introduction of Ethereum’s London fork in August 2021, a part of each transaction fee charged by the network is automatically burned. From August 5, 2021 — the date of the fork’s activation — to the time of writing on May 19, 2022, a total of 2,345,913 ETH have been burned on the blockchain. At ETH’s current price of $2,010 USD, this represents a value of over $4.7 billion USD.

The 2.3 million ETH burned so far represents less than 2% of ETH’s supply of over 120 million, hardly a figure that could significantly affect the coin’s price.

BNB Burns

Binance Holdings, the owner of the BNB chain, introduced quarterly BNB coin burns in October 2017, with the goal of gradually reducing the total supply of the crypto. Between October 2017 and late 2021, 33.2 million BNB were burned in 17 quarterly coin burns.

Using the BNB price at the time of each burn event, these 17 burns total to over $2.2 billion USD.

After the 17th quarterly burn, the BNB chain introduced an auto-burn mechanism built into each transaction. The mechanism went live in December 2021. The auto-burn feature currently supplements the quarterly burns.

The chain conducted its 18th (in January) and 19th (in April) quarterly burns, in addition to using the regular auto-burn enabled for each transaction. As of the time of writing, a total of 37.7 million BNB has been burned via both the 19 quarterly burns and the auto-burn. This represents 16.9% of BNB’s original supply of 200 million.

While ETH’s share of burned coins, at under 2%, is negligible, the nearly 17% figure for BNB is far from trivial. Has this significant supply reduction helped the coin’s market performance? The short answer is probably no.

Since November 2021, BNB has largely been on a downtrend, mirroring BTC’s and the overall crypto market’s pitiful performance. The supply reduction mechanism, that features so prominently in BNB’s functionality, has not helped the coin perform any better than most other cryptos, including those that have never entertained the idea of a token burn.

Conclusion

As an individual crypto holder/investor, you should probably take the idea of a token burn to improve the asset’s price with a grain of salt. At best, price rises for a cryptocurrency following a burn event may be short-lived, and oftentimes they do not materialize at all.

Ad-hoc, highly publicized burns are often PR stunts, and supply reductions after these events may fail to provide lasting positive effects on the coins.

If you prefer to invest in established, high-cap coins with a regular burn mechanism, BNB and ETH coins would be the obvious choices. Do note, however, that these coins’ burn functionality is not likely to have a significant effect on their market performance in the foreseeable future.