Initial Coin Offering (ICO) was the first fundraising method in the crypto space. Ethereum was the first project to use ICO to fund development efforts in 2014. This method was very popular until early 2018, and thousands of startups raised millions of dollars. However, by early 2018, the acronym had gotten a bad reputation. As a result, it has been replaced by several creative alternatives designed to improve the process of the much-derided ICO.

ICO instead of IPO

In short, ICOs are similar to initial public offerings (IPOs). The difference is that in an IPO, investors receive real shares in the company, while ICO participants receive project tokens. And unlike IPOs, ICOs aren’t regulated by law.

In the US, for example, the issuer (a company necessarily incorporated as a public company) must be registered with the SEC (Securities and Exchange Commission) for a public stock offering. The registration process itself is complex and lengthy.

The company must disclose a sufficiently large amount of information (including financial statements). At the same time, each stock exchange establishes its own requirements for the issuer to pass the listing procedure. For example, the exchange may specify the required number of shareholders, the company’s revenues in the last year, the value of its assets, etc. For this reason, an ICO could be an effective way to financially support projects in the early stages of development.

Security Token Offering (STO)

The word security is here for a reason — the Securities and Exchange Commission personally regulates such token offerings. The strategy is only suitable for honest projects that want to attract the attention of large investors. The last ones often get all the tokens of a new project.

STOs are divided into different categories. Reg D, for example, is called STO, in which only institutional investors can invest. The Reg S category is assigned to teams outside the United States, and Reg A + denotes the highest level of reliability. Among the biggest STOs are the startups Gab.ai, Knowbella, and dexFreight.

Interactive Initial Coin Offering (IICO)

Interactive Initial Coin Offering (IICO) was first proposed as a fairer ICO model in an article by Vitalik Buterin. It aims to prevent FOMO and “gas wars” that could lead to whales getting all the tokens and crowding out smaller investors. In a Fantom fundraiser, for example, one investor spent $24,000 on gas just to get ahead in the queue with his transaction.

Authors can set a maximum size for sales; if the money earned exceeds this amount, their funds will be returned. This ensures that everyone is able to buy tokens at a price they feel is fair — at least in theory. The decentralised Kleros protocol became the first project for the IICO trial.

Initial Exchange Offering (IEO)

The Initial Exchange Offering, as the name suggests, is held on the exchange’s platform. Unlike ICOs, where startups have to manage the entire fundraising process themselves, IEOs are managed by an exchange on behalf of the startup.

Since the exchange’s platform handles the token sale, the token issuers have to pay a listing fee in addition to the percentage of tokens sold during the IEO. In return, the crypto startups’ tokens are sold on the exchanges, and the coins are distributed by the platform after the end of the IEO.

Unlike ICOs, which require users to send money to a smart contract, IEO participants must create an account with the platform hosting the IEO and complete a KYC (Know Your Customer) verification. Members deposit money into the exchange’s wallets using coins, then use that money to buy tokens sold by the fundraising company.

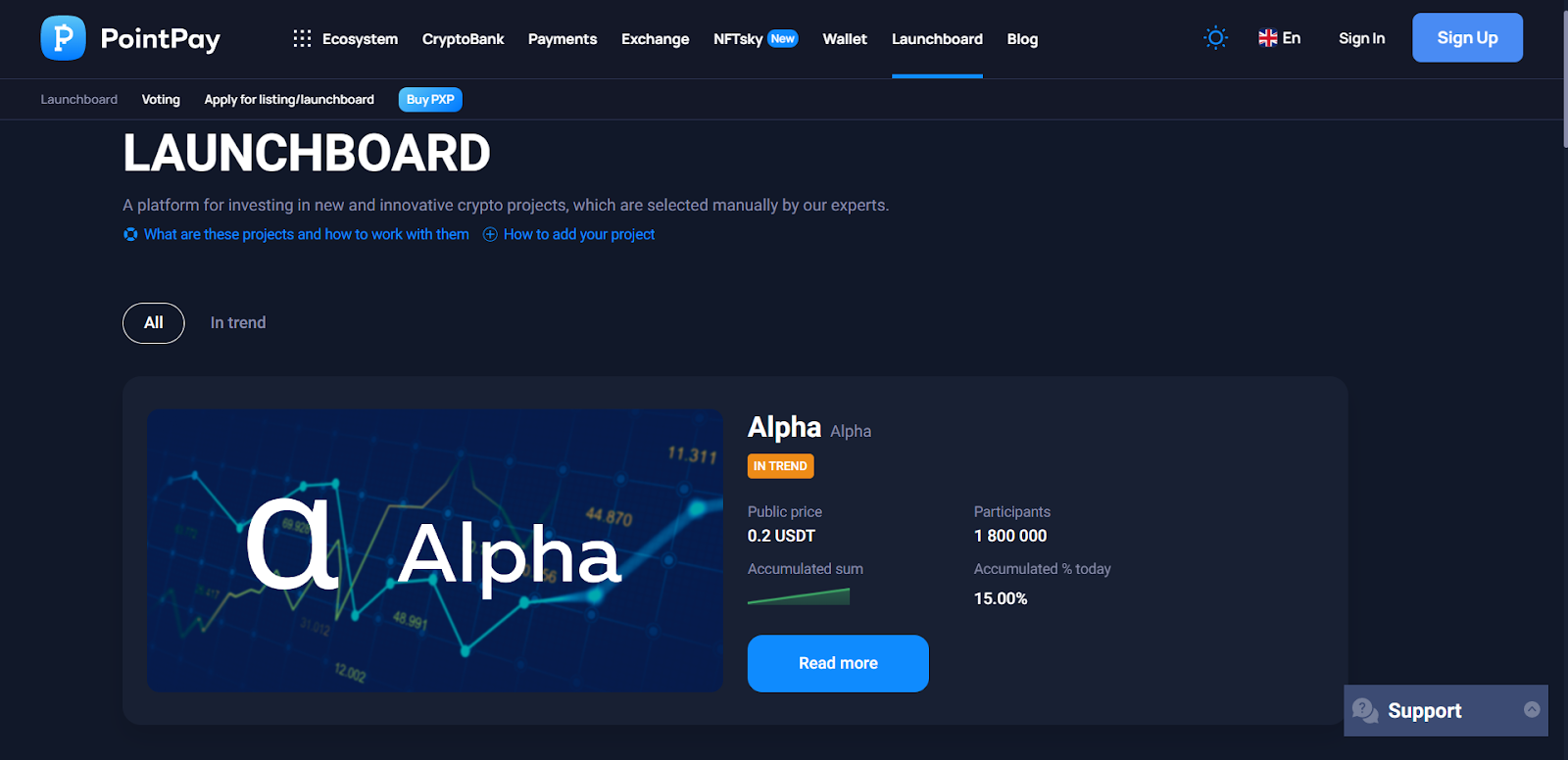

One of the first was Binance, which released its IEO platform Binance Launchpad. Following the success of Binance Launchpad, other well-known exchanges have also announced the launch of their own IEO platforms. PointPay Launchboard is one of these IEO platforms. Users of the PointPay platform can vote on which project should be listed on the Launchboard.

Advantages of the PointPay Launchboard

- Trust

We review every project that wants to collect funds on our IEO platform. Our reputation is important to us, so we check token issuers carefully. That’s why you can be sure that we won’t list any fraudulent or dubious projects on our platform.

- Security

Our team manages the IEO smart contract, so token issuers don’t have to worry about security. We also handle the KYC/AML procedures.

- Ease for projects

Startups issuing tokens benefit from a more seamless process than launching their own ICOs. Projects require a smaller marketing budget and gain access to our active customer base to facilitate market entry.

- Listing

Projects that launch their tokens on the Launchboard platform also receive a priority listing on the PointPay exchange.

Initial Dex Offering (IDO)

Initial DEX Offering is a token launch model that involves raising funds on a decentralised exchange. The cryptocurrency project provides tokens to the DEX, then users deposit their funds via the platform, and the DEX completes the final distribution of the tokens. These processes are automated thanks to smart contracts.

As with ICOs, there are almost no requirements for investors or developers at IDO. This is why this method of raising money has become very popular among DeFi projects in 2020.

Initial Game Offering (IGO)

Initial Game Offering (IGO) is a way for blockchain gaming projects to raise capital, similar to an Initial Coin Offering. Still, apart from cryptocurrency tokens, IGO participants can get early access to in-game assets. These assets are often limited edition game items such as skins, accessories, weapons, and other NFTs (non-fungible tokens). In most cases, these are NFTs that you can use to access and play the game.

IGOs are usually organised via Launchpad platforms. In some cases, the tokens and NFTs acquired by IGOs can be traded outside the game ecosystem on decentralised exchanges and NFT marketplaces.

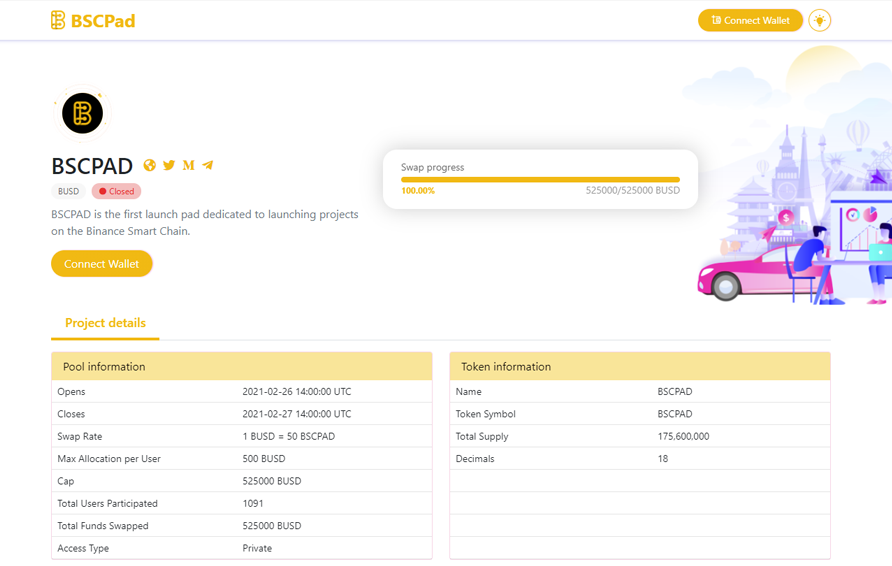

There are currently several IGO launchpads on the market, including BSCPad or TrustSwap.

Launchpads have different settings for IGO, but generally, investors must purchase the platform token to participate. After purchasing the required digital assets, participants must lock them in the pool for a certain period. Depending on the distribution algorithm, they receive a project token or NFT corresponding to the number of locked tokens.

Initial Farm Offering (IFO)

An Initial Farming Offering (IFO) is a new type of token sale or distribution method popularised by decentralised exchanges using Automated Market Maker (AMM) models to ensure market liquidity. IFOs differ from IEOs and ICOs as they’re geared towards liquidity farms.

To participate, users simply need to supply funds to the liquidity pool eligible for the IFO. These users are eligible for rewards, and new project owners can take advantage of the liquidity pool offered by the platform. Most of these tokens are managed by the community and have little or no control over a specific central authority. The process provides additional liquidity to the decentralised protocol that hosts it.

One of the most popular IFO platforms is PancakeSwap, whose users can directly benefit from fundraising.

Closing thoughts

The ICO market has been depleted in recent years due to legal uncertainty and an influx of fraudulent projects. Fraudsters target token sales organised by promoters, while investors lack protection and financial regulators tighten their measures. Several alternative fundraising methods have emerged in the last five years. Let’s see if they can transform the industry by addressing these issues.