As part of our recent global update, we have made significant improvements to the Savings system. It is now faster, more user-friendly, and easier to understand. Let's delve into the details.

The Savings Account system on the PointPay platform allows users to store their funds and earn interest on them. Unlike Staking, Savings Account offers the advantage of no fund lock-up. This means you can deposit or withdraw funds from your Savings Account at any time, providing you with maximum flexibility.

It's a convenient way to passively generate a small income while retaining full access to your funds. Currently, it is the most preferred method for storing cryptocurrencies on the PointPay platform.

How does the system work?

The Savings Account system acts as an additional wallet for cryptocurrencies, where you can transfer funds that you don't plan to use in the near future. Perfect for HODLers.

When you deposit funds into your PointPay wallet, all the cryptocurrency initially goes to your Regular Account, where it remains available for immediate use or further transfers. You can utilize it for trading or transfer it to other accounts. However, if you have cryptocurrency that you don't plan to use in the short term, you can transfer it to the Savings Account, specifically designed for storing cryptocurrencies.

You can transfer any amount to the Savings Account, either all at once or in parts. However, once the cryptocurrency appears in your Savings Account, a reward distribution period of 30 days begins. At the end of this period, a reward will be credited to your Savings account. The reward amount typically ranges from 0.1% to 1.1% depending on the cryptocurrency. If more transfers are made during the period, compound interest is calculated and the period is not reset.

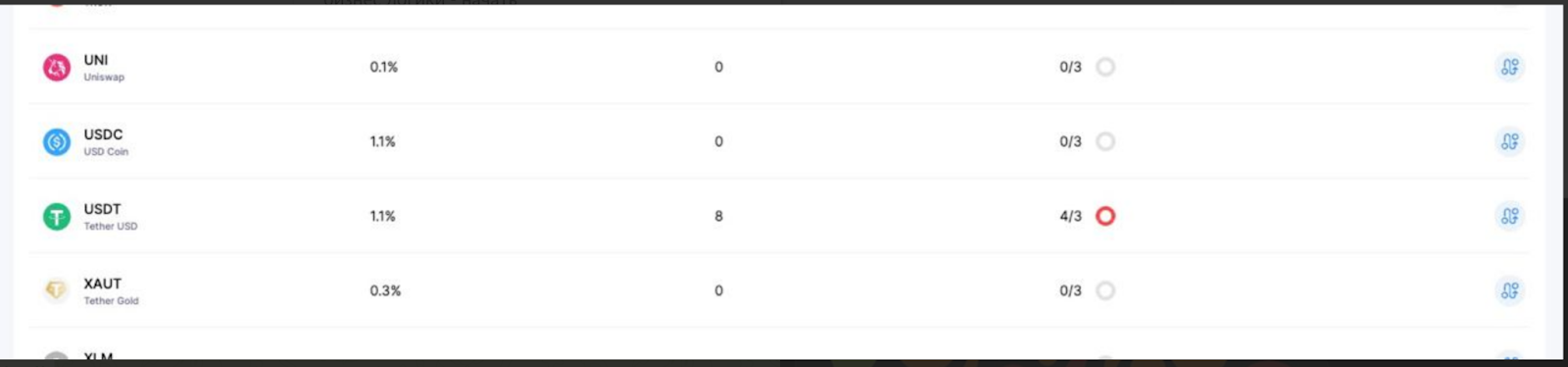

Please note that there is a limitation on the number of withdrawals from the Savings Account for each currency. You can only make three withdrawals per period (30 days) for each cryptocurrency. After utilizing all three withdrawals, you will still be able to withdraw funds from the savings account, however you will lose the interest rate for this reward period.

Also, there are no restrictions on the transfer volume, allowing you to withdraw the entire amount of cryptocurrency in one transaction.

Here’s some examples of interest periods:

- January 1 transfer to Savings -> interest credited on February 1

- January 15 transfer to Savings -> interest credited on February 15

- January 29, 30, 31 transfer to Savings -> interest credited on February 28

- April 30th transfer to Savings -> interest credited on May 30th

*Interest period is defined based on your initial deposit. This period remains per currency. Some examples:

- If a user made a BTC initial interest deposit on January 15 2021. The interest period is locked to the reward payment on 15th each month

- The user may have another interest deposits ETH currency on February 10 2022, so the interest period for ETH will be locked to the reward payment on 10th each month.

Transfer cryptocurrency to savings

If you have cryptocurrency and wish to transfer it to the Savings Account, and also learn about the reward period and interest rate, follow these steps:

- Log in to your account and ensure that the cryptocurrency is in your Regular Account.

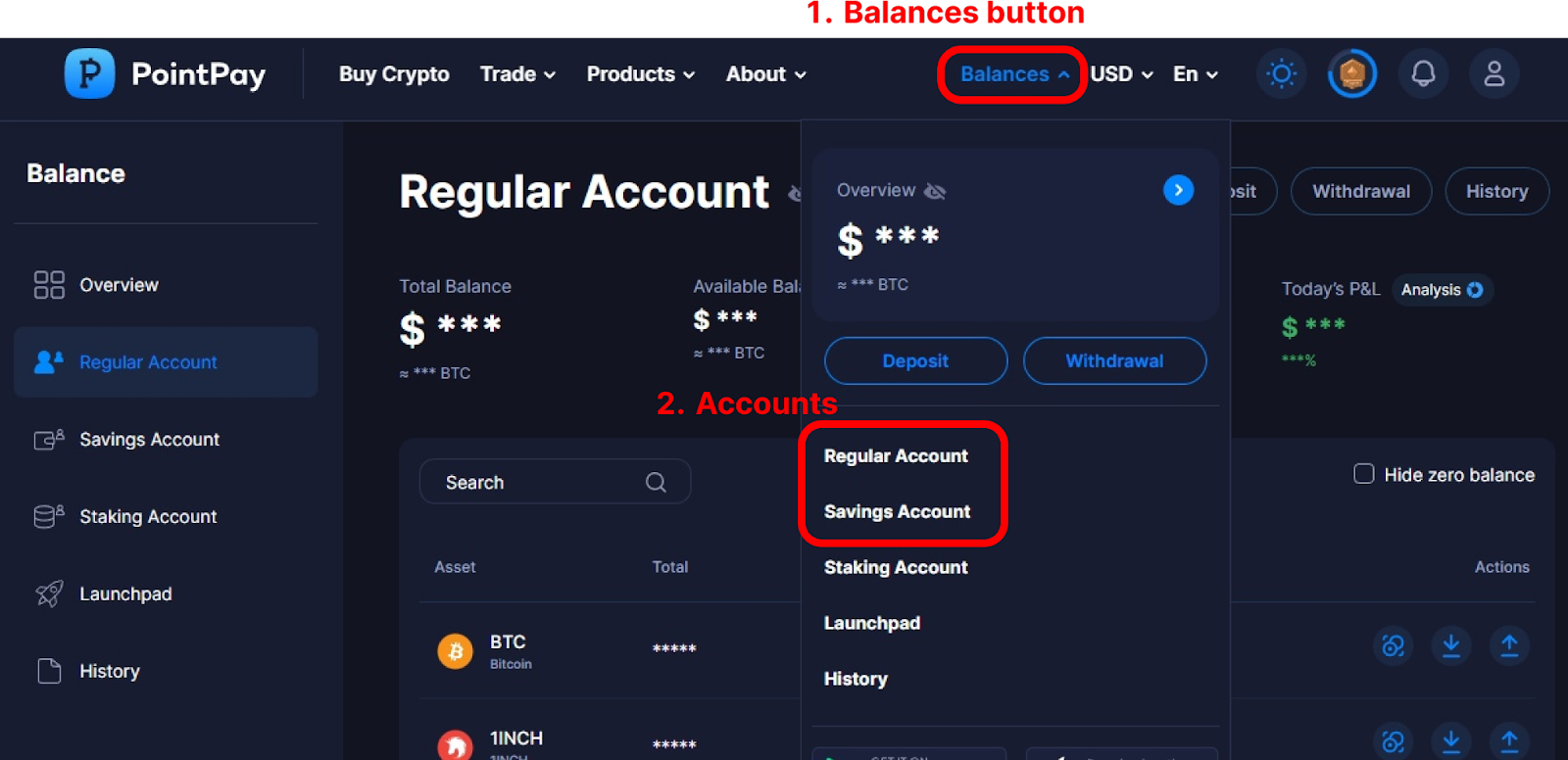

- To access your Regular Account quickly, click on the "Balances" button, then select "Regular Account."

- Once in the Regular Account, locate your desired cryptocurrency.

4. To transfer to the Savings Account, navigate to the Savings Account page via the left menu or the same process as with the Regular Account. Find your cryptocurrency there. Ensure that the "Hide zero balances" checkbox is disabled as the current balance is 0 in the Savings Account.

5. Once you find the desired asset, you can gather all the relevant information.

6. To proceed with the transfer, click on the button on the right. This will open a transfer window where you can select the cryptocurrency (if needed), the withdrawal account (Regular), and the receiving account (Savings). At the bottom, enter the amount of cryptocurrency to transfer or click the "Max" button to transfer the entire available amount of the selected cryptocurrency.

Please note that the transfer may take a couple of minutes to complete. Refresh the page to see your cryptocurrency in the Savings Account. After the reward period is completed, you will receive your interest reward at at 00:00. The length of reward periods may vary due to number of days in the month when you deposited funds to your savings account. Please, see examples listed above.

Summary

With the recent update, the Savings Account has undergone improvements as part of the platform-wide update. From PointPay's perspective, we have focused on enhancing the UI/UX design, revamping the backend system for data transmission, processing, and storage, and improving the integration between Accounts and other services.

For users, the primary change is the redesigned interface. It provides a significantly improved user experience, making it easier and faster to navigate and perform actions on the Accounts screen. The interface is more responsive and visually appealing. You can now easily check both the overall account balance and the balance of individual cryptocurrencies. Additionally, the algorithms calculate and display your current daily profit and loss (P&L).

Overall, these updates enhance the user's quality of life and improve their experience when using PointPay. We hope that you fully enjoy the update and kindly share your feedback with us on social media!

🔥 Buy PXP tokens on Bittrex: https://bit.ly/32VWsci

🔥 Buy PXP tokens on Bitrue: https://bit.ly/3JEreHu

🔥 Buy PXP tokens on WhiteBIT: https://bit.ly/3qJrjRH

💰 Earn up to 7% yearly with PXP staking program in PointPay Bank: https://pointpay.io/staking

💡 Check PointPay Live-Roadmap (PointPay development in real-time): https://pointpay.io/live-roadmap/

🏦 Remember, we are PointPay, and we are beyond banking!