The major cryptocurrency — Bitcoin — was created as an electronic payment system that uses a digital ledger to store and verify transactions. Whether you want to receive BTC to your personal wallet, accept a cryptocurrency payment on the website, or send digital assets, you need to understand how the transactions work.

How Bitcoin transactions work

Transactions are email-like messages that are digitally signed using cryptography and validated across the Bitcoin network. Every Bitcoin transaction is public, so you can view it on the blockchain.

Let’s take an example: Alice wants to send BTC to Bob, she must initiate the transaction and the network must confirm this transaction. First, the network verifies that Alice has enough Bitcoins to send and confirms that she did not send those Bitcoins to someone else. After this verification, the transaction is added to the block and other blockchain transactions. Transactions that are added to the blockchain are irreversible.

Each transaction consists of three elements: Input, Amount, and Output.

- Input — a record of the address from which Alice originally received the Bitcoins she wants to send to Bob.

- Quantity — this is the specific quantity of BTC that Alice wants to send to Bob.

- Output — This is Bob’s public key, also known as his Bitcoin address.

More about transactions

Sending BTC requires access to the public and private keys associated with the required amount of Bitcoins. When we say that someone has Bitcoins, we actually mean that person has access to a key pair consisting of:

- The public key to which a certain amount of Bitcoins was previously sent,

- The corresponding unique private key allows the BTC previously sent to the public key to be sent to another location.

Public keys, also called Bitcoin addresses, are a random sequence of letters and numbers that work just like an email address. Your Bitcoin address is a unique identifier required to send and receive BTC. Heads up: if you want to receive BTC in your wallet, you should share your public address with a sender.

While Bitcoins are transferred from one wallet to another, they are not stored in those wallets. Instead, wallets store BTC addresses, that record all your transactions. Same as the public key, the private key is a sequence of letters and numbers. However, private keys, like passwords for emails or other accounts, must be kept secret. Otherwise, your funds can be stolen.

You can compare your public key to an email and your private key to an email password. You can share your email address, so others can email you, but you do not have to share your password with anyone. So public and private keys do not give you access to your emails; they give you access to Bitcoins.

Let’s return to our example of Alice and Bob. After Alice provides the transaction details (the amount and the address of Bob’s wallet), she enters her private key into the system to “sign” the transaction, after which the Bitcoins are sent. The transaction is now ready to be verified on the network. The network determines if the signature (private key) matches the public key. If everything is in order, the miners confirm the transaction. Once the transaction between Alice and Bob has received three confirmations, the data is transferred to the blockchain, and Bob receives his Bitcoins. The miners receive a small commission in Bitcoins for each confirmed block as a reward.

Transaction time

The time interval for transactions depends on the congestion of the entire blockchain network. The average time per transaction is twenty minutes to one hour, but if the network is overloaded, the transaction time increases many times. Sometimes the network reaches peak moments when the average transaction volume in blocks increases tremendously, and the blocks themselves grow to the limit.

Transaction fees

The Bitcoin fee determines the speed at which a transaction enters a block. Setting too low a commission can lead to significant delays in transaction confirmation. Entering an excessively high commission leads to unjustified expenses. For proper commission size, consider the values of the main parameters that affect its size:

- The number of unconfirmed transactions: your transaction will compete with others for inclusion in the block. The block size is limited, and the more unconfirmed transactions are waiting for confirmation, the more competition between them.

- Fee for other transactions: users can increase the fee to speed up the confirmation of transactions. Therefore, to set a competitive commission, it is worth checking the minimum and average commission in the network now.

- Luck of the miners: blocks in the Bitcoin blockchain are created on average once every 10 minutes, but this number is probabilistic. For example, there may be several blocks in a minute, or there will be no new blocks for an hour. The higher the luck of the miners and the more often the blocks are found, the more likely it is that even transactions with a low commission will slip through. And during periods of low luck, they can freeze, and transactions would be affected by a sufficient commission at the time of sending.

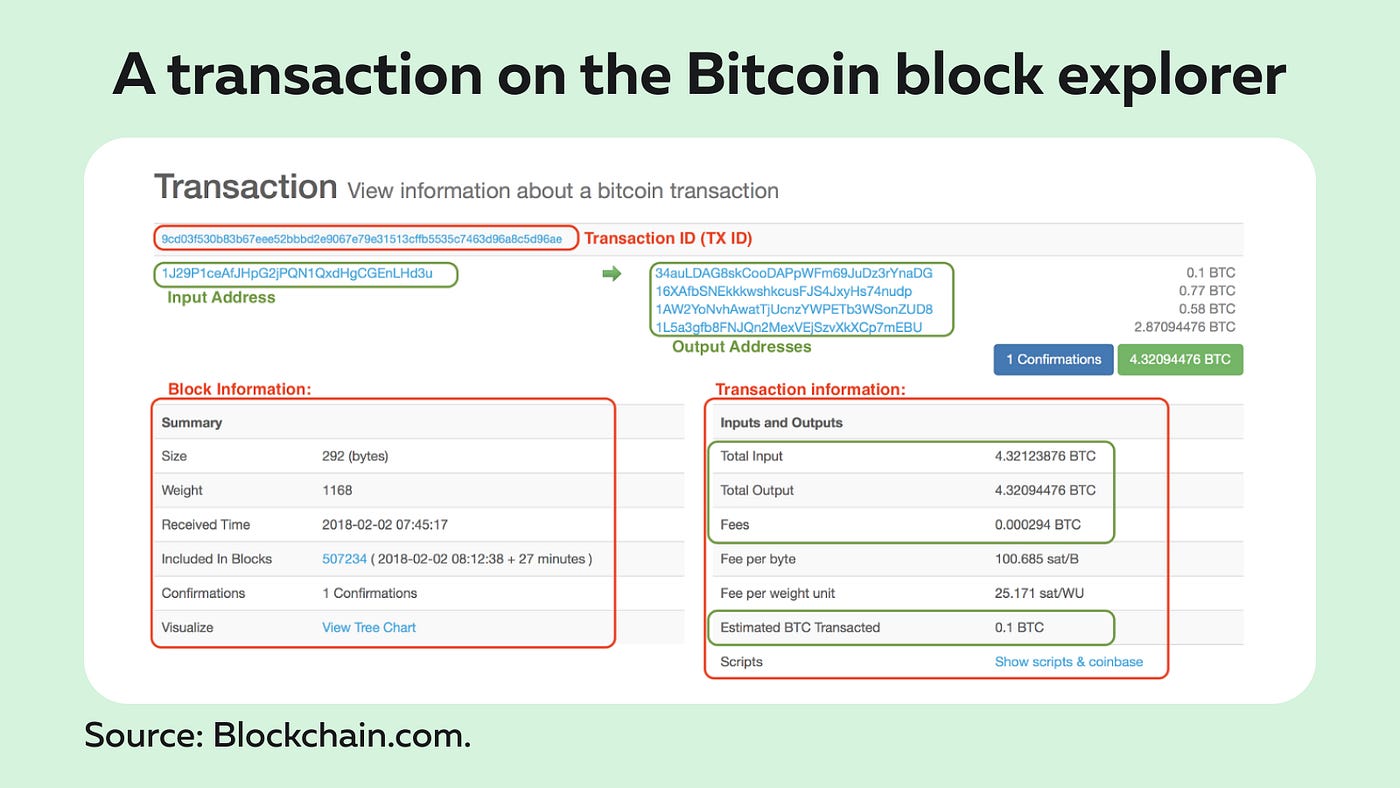

How do I verify a transaction?

You can track your bitcoin transaction on the network using public resources such as Blockchain.info and Chain.so.

To determine the number of operations for a single transaction, you need to:

- Go to the selected page of the public resource;

2. Enter the combination of the hash operation you need in the search bar.

After that, you will be able to see all the information about the current status of the block.

Easily buy and send BTC with PointPay

You can easily buy BTC via the PointPay platform, as we have integrated several fiat-to-crypto and crypto-to-crypto payment providers. The suitable transaction fee’s size will be calculated automatically by the platform. You can easily send your Bitcoins to another user either via the public address or via email using the ”PointPay me!” feature on the platform.